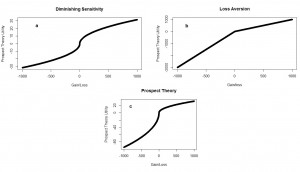

Prospect Theory, created by Kahneman and Tversky, is a way to quantify utility functions for people. In traditional economics, a dollar is a dollar and people are expected to maximize their wealth. In reality, people have biases. The two major biases shown in prospect theory are diminishing sensitivity and loss aversion.

Diminishing sensitivity makes people notice $1 changes in their wealth less the farther that they get from their reference point. $1 means a lot more to someone who is close to breaking even than to someone else who has already made a million dollars.

Loss aversion refers to the fact that people feel losses more strongly than equal sized gains. A loss of $100, relative to your reference point, feels worse than a gain of $100 feels good.

The effects can be seen in the following pictures. (a) isolates diminishing sensitivity and (b) isolates loss aversion. Their combined effects are shown in (c).